CFO Services

Strategic Financial Leadership through Our Four-Stage Model

Strategic Financial Leadership through Our Four-Stage Model

Every growing business eventually hits a financial ceiling — not because of a lack of ambition, but due to the absence of structured financial leadership. CFO Pulse bridges this gap with a transformative approach that delivers the expertise of a complete finance team, without the full-time cost.

Our four-stage model ensures businesses not only stay compliant but grow with confidence, clarity, and strategy.

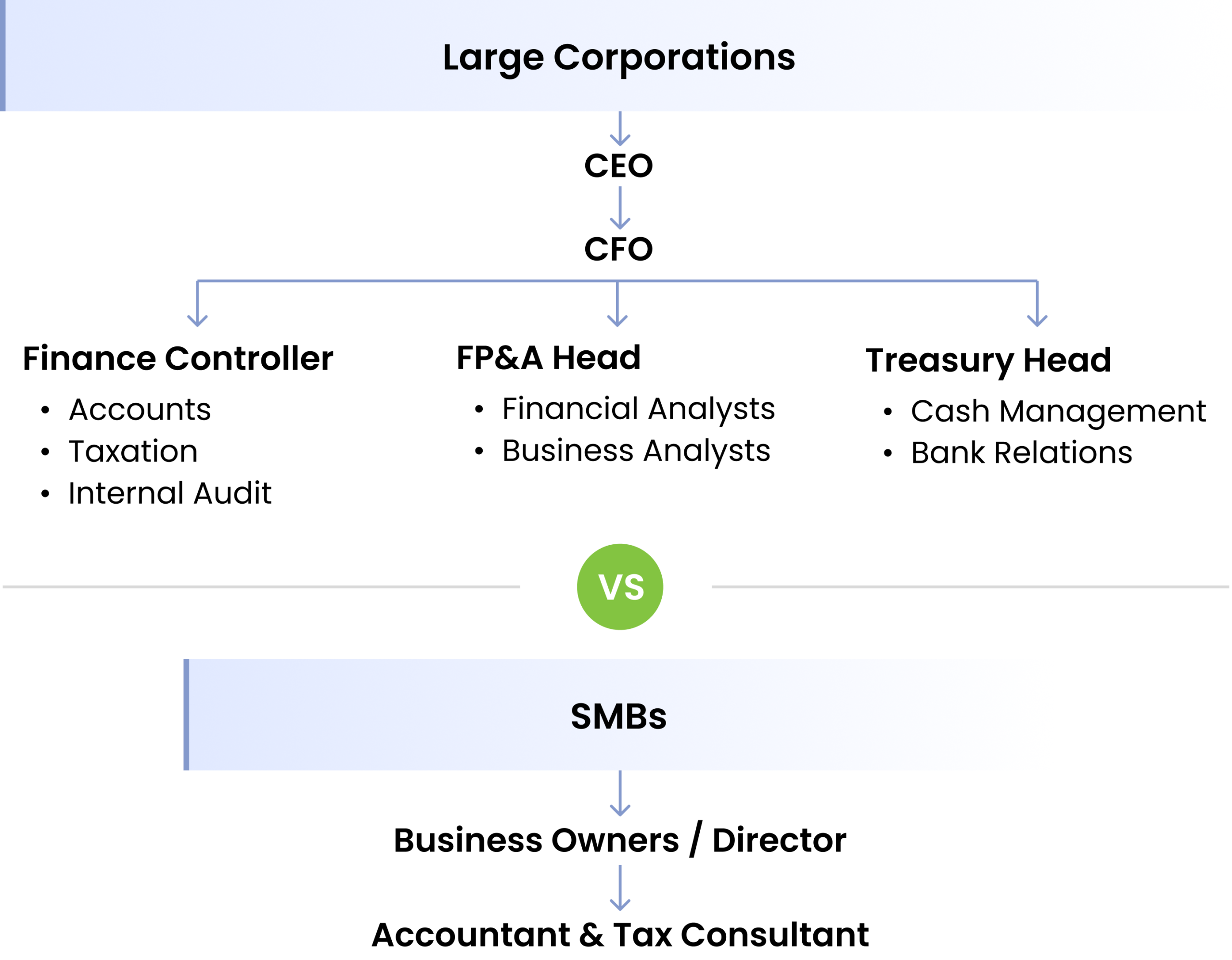

Problem : The Financial Leadership Gap

Most SMBs operate without a true CFO — leading to :

Poor cash flow

visibility

Disconnected Excel-based reporting

Absence of budgeting, forecasting, or planning

Business decisions made on gut-feel, not data

Large enterprises have financial departments. Small businesses have bookkeepers.

But the middle layer — where analysis meets strategy — is often missing.

Solution : The CFO Pulse Four-Stage Model

We don’t offer generic advisory. We implement a structured, outcome-driven model tailored to your business size, sector, and growth goals.

Stage 1 : CFO Shield

Ensuring Compliance & Accuracy

Problem :

Inaccurate data, missed filings, and compliance risks

Solution :

- On-site financial process reviews

- Book-Keeping and Accuracy

- Statutory compliance & audit preparedness

Benefit :

A clean financial foundation you can rely on for reporting and decisions

Stage 2 : CFO Dashboard

Building Robust Reporting Systems

Problem :

Static, fragmented Excel reports don’t support modern decision-making

Solution :

- Power BI dashboards customized to your needs

- Real-time visibility into cash flow, profitability, and performance

- Integrated reporting from ERP/accounting systems

Benefit :

Instant access to the metrics that matter — anytime, anywhere

Stage 3 : CFO Lens

Financial Planning & Analysis

Problem :

No forecasting, budgeting, or cost diagnostics = reactive decision-making

Solution :

- Monthly forecasting and rolling budgets

- Expense and trend analysis

- Benchmarking against industry peers

Benefit :

Smarter allocation of resources, clear roadmap for profitability

Stage 4 : CFO Brain

Strategic Advisory & Business Evaluation

Problem :

Critical business decisions made without financial strategy

Solution :

- Financial evaluation of new projects, expansion, diversification

- Cost-benefit and ROI modeling

- Risk management models and strategic reviews

Benefit :

Business moves backed by numbers, not guesswork

How we create Value

20–30% reduction in cost leakages & financial inefficiencies

95%+ accuracy in cash flow forecasting

Improved gross margins and unit economics

Board/investor-ready financial clarity

Confidence in scaling, fundraising, or transforming operations

Why Choose CFO Pulse?

Traditional Consultants

Advisory Only

Periodic Reports

Generic Strategy

Focused on Compliance

One-time Project

CFO Pulse

Advisory +Full Implementation

Real-Time Dashboards

Industry-specific insights

Focused on growth & scale

Ongoing partnership

Ready to Build a Financially Smarter Business?

Let us help you transition from reactive to proactive finance.

Take the first step toward Financial Excellence.

Case Studies

Ready to take your finances to the next orbit?

Let’s talk! Book your free consultation today